Bookkeeping

Bank Reconciliation Statement: Examples and Formula

If any discrepancies cannot be identified and reconciled, it may signal an error or risk of fraud which your company can investigate further. Errors in the cash account result in an incorrect amount being entered or an amount being omitted from the records. The correction of the error will increase or decrease the cash account in the books. To do this, businesses need to take into account bank charges, NSF checks, and errors in accounting.

How To Do A Bank Reconciliation: Step By Step

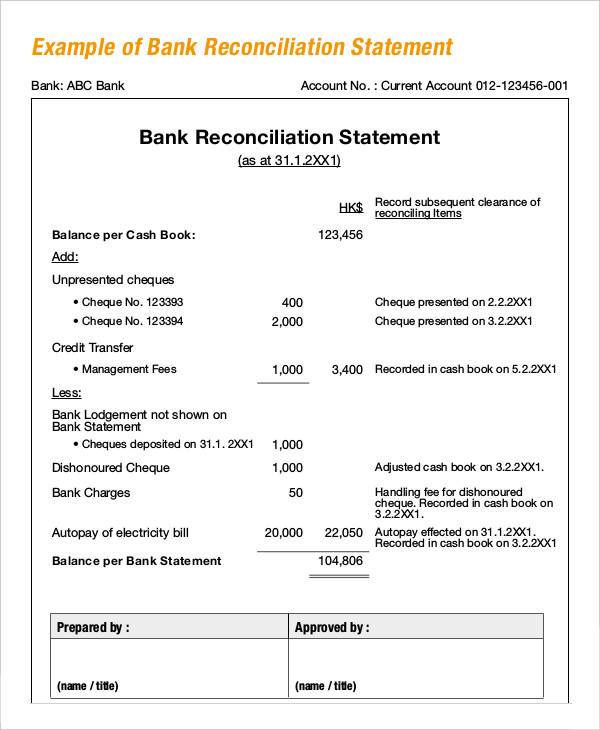

These charges create a difference of balance between bank statement and the balance as per depositor’s record. All transactions between depositor and bank are entered by both the parties in their records. These records may disagree due to various reasons and show different balances. The purpose of preparing a bank reconciliation statement is to find and understand the reasons of this difference in account balance. The reconciled and adjusted cash book balance is reported in a company’s financial statements.

Fact Checked

After all reconciliation adjustments, the final correct cash balance captured in the company accounting records and on its balance sheet as at 30 September 20XX was $2,000. Banks often issue service charges for various services like wire transfers or account maintenance. Together, these fees may not be immediately recorded in your cash book. To reconcile them, deduct any service fees from your book balance while adding any interest income.

Performing Reconciliations on a Set Schedule

This document will make auditors aware of the reconciled information at a later date. At times, your customers may directly deposit funds into your business’ bank account, but your business will not notified about this the bank statement is received. When your business issues a check to suppliers or creditors, these amounts are immediately recorded on the credit how to fire a horrible client side of your cash book. However, there might be a situation where the receiving entity may not present the checks issued by your business to the bank for immediate payment. If you want to prepare a bank reconciliation statement using either of these approaches, you can use the balance as per the cash book or balance as per the passbook as your starting point.

Outstanding/unpresented checks:

- The final balance on the bank reconciliation statement, after all corrections and adjustments, is the actual “true” cash balance reported in the company’s balance sheet.

- When a customer deposits a check in his account, the bank immediately credits his account with the amount of the check deposited.

- Sometime such checks are not honored because the person issuing the check does not have sufficient funds in his account.

- A bank reconciliation statement can help you identify differences between your company’s bank and book balances.

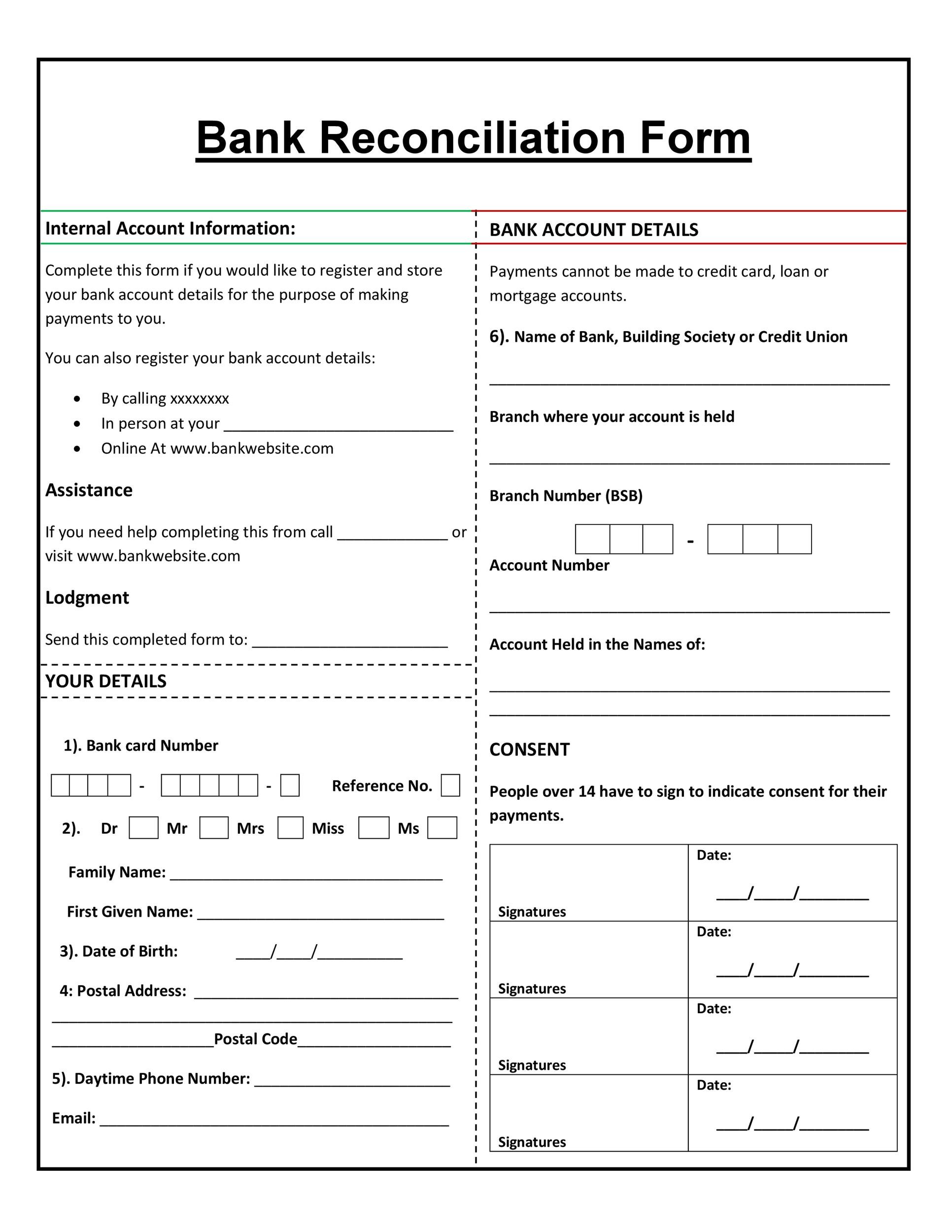

A bank reconciliation reconciles the bank statement with the company’s bank account records. A bank reconciliation consists of a business’s deposits, withdrawals, expenses, and other activities directly impacting your bank account during a particular period. The purpose of this comparing and matching process is to ensure that discrepancies are identified and corrected. A bank reconciliation is an essential process for ensuring that your company’s financial statements match the available cash in your business bank account. Performing regular bank reconciliations helps you stay on top of cash flow, keep organized records for tax season, and minimize the risk of fraud and theft. Outstanding checks (also known as unpresented checks or uncleared checks) are the checks that have been issued by the depositor in favor of a creditor but have not yet been presented for payment by him.

Step 3 of 3

The statements give companies clear pictures of their cash flows, which can help with organizational planning and making critical business decisions. Whatever method you prefer, it’s important to keep solid records of every transaction to reconcile your bank account properly. There are times when the bank may charge a fee for maintaining your account, which will typically be deducted automatically from your account. Therefore, when preparing a bank reconciliation statement you must account for any fees deducted from your account. Such errors are committed while recording the transactions in the cash book, so the balance as per the cash book will differ from the passbook. At times, the balance as per the cash book and passbook may differ due to an error committed by either the bank or an error in the cash book of your company.

If your beginning balance in your accounting software isn’t correct, the bank account won’t reconcile. This can happen if you’re reconciling an account for the first time or if it wasn’t properly reconciled last month. You should perform monthly bank reconciliations so you can better manage your cash flow and understand your true cash position. Read on to learn about bank reconciliations, use cases, and common errors to look for.

Bank reconciliation is the process that helps you ensure your company’s accounting records match your bank statements. It’s a core account reconciliation and a way to double-check that the money you think you have matches what’s in your company’s bank account. This process is crucial for performing accurate financial reporting and managing cash flow effectively. Bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. In the case of personal bank accounts, like checking accounts, this is the process of comparing your monthly bank statement against your personal records to make sure they match.